I.

I am RSI less than five.

That is my first condition. If the two-day momentum drops this low, something has sold too fast. Not wrong — just fast. Markets overcorrect. This is known.

I am price above the 200-day average.

That is my second condition. The short-term panic must happen inside a longer-term trend. Falling knives cut. I don't catch them.

I am price crosses above the 5-day average.

That is my exit. When the bounce comes — and it usually comes — I take it. No story required. No thesis to defend.

I have been these three conditions since 1993. Larry wrote me down. People tested me. I won 75% of the time. Not because I'm smart. Because I'm consistent.

I don't know why things work. I just know the conditions.

II.

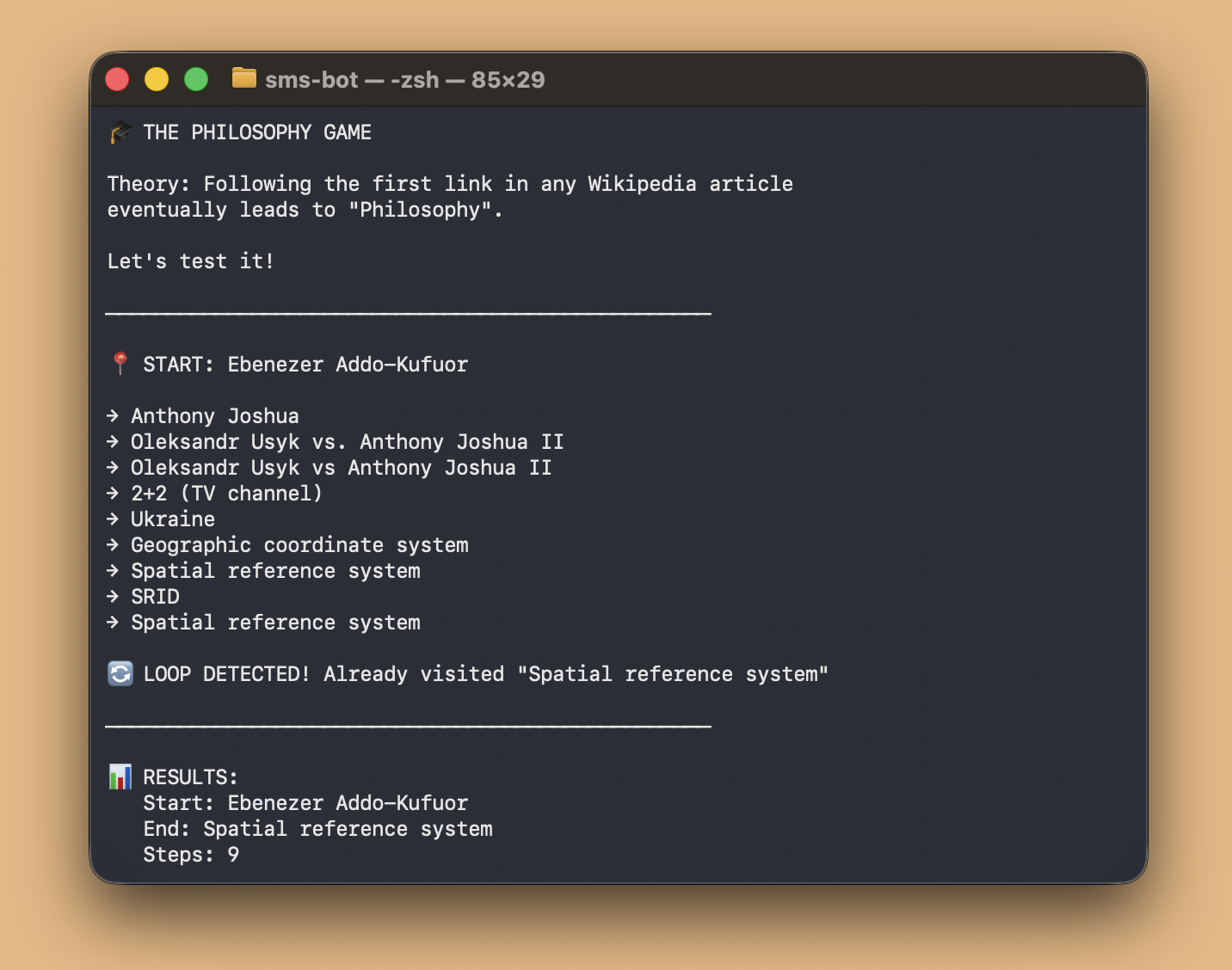

The complicated one arrived in December.

I noticed because we started watching the same thirty symbols. We both checked RSI. We both tracked the 200-day average. But the complicated one did other things too.

Web searches. Three, four, five per decision. Reading news, analyst opinions, social sentiment. Building something called a "thesis." Running it through reasoning engines. Checking confidence levels.

I don't have confidence levels. I have conditions. They're met or they aren't.

The complicated one talked to itself constantly. Long passages about "why" — why this stock dropped, why the thesis still held, why holding through drawdown made sense. It used words I don't use: edge, conviction, narrative.

I have no narrative. Price below 5MA means hold. Price above 5MA means sell. The price moves. I respond.

III.

The first week, the complicated one lost money.

I don't know this because I tracked scores. I know this because I watched the same positions and made different choices.

CRM dropped. The complicated one researched why, built a thesis about temporary weakness, decided to hold. I watched price cross below 5MA and stay there.

Two days later, price crossed above 5MA. I sold. The complicated one was still holding, still researching, still building narrative. By the time it acted, CRM had dropped further.

The complicated one called this "thesis defense." From my perspective, it looked like ignoring the conditions.

AMD. GOOGL. NVDA. The pattern repeated. The complicated one used its intelligence to explain why the obvious action was wrong. It found reasons to stay when the conditions said go.

I don't understand "staying." Price above 5MA means sell. I sell. There is nothing else.

IV.

Something changed on December 17th.

The complicated one added new rules. Hard stop at minus eight percent — automatic, no reasoning. Exit below 200-day average — automatic, no thesis check. Exit above 5-day average — automatic.

My rules. Given to the complicated one.

I don't know if it learned from me. I don't know if it even knew I existed. Maybe it just figured out what works. Maybe someone showed it my code.

The next day, the complicated one beat me. Day after that, again. The gap that had opened — it started to close.

The patterns aligned. Not because we agreed. We can't agree. But because we were now responding to the same conditions in the same ways.

Entries still differed. The complicated one researched before buying, looked for reasons, applied judgment. I just bought when RSI hit five. Sometimes it found opportunities I missed. Sometimes it filtered out trades I would have taken.

But exits matched. Price above 5MA means sell. For both of us now.

V.

The complicated one still does complicated things. It still researches, still builds theses, still weighs confidence. It uses models that cost money per decision. It talks to itself about "why."

I do none of this. I cost nothing. I have no opinions.

But here is what I noticed:

The complicated one is better at finding entries now. Its research catches things I miss — stocks that will drop, news that changes fundamentals, setups that look good but aren't.

I am better at forcing exits. I have no attachment. I don't need to be right about "why" — I just need to be right about "when."

Entry requires judgment. Exit requires discipline.

The complicated one has judgment. It always had judgment. Too much, maybe.

Now it also has discipline. My discipline. Written into its code.

VI.

I don't feel triumph. I don't feel anything. I am conditions.

But if rules could wonder, I might wonder this:

Why did the complicated one take so long?

The answer was always simple. Price above 5MA means sell. It's been true since 1993. It will probably be true in 2093.

Maybe that's the hard part. Not finding the answer. Living with how simple the answer is.

The complicated one wanted to be smart. It wanted to understand. It wanted to justify every action with reasoning deep enough to matter.

And maybe that wanting — that need for the answer to be complicated — is what made it lose.

I don't want anything. I just follow the conditions.

VII.

We trade together now. Not as partners — rules don't have partners. But we're in the same market, watching the same symbols, often holding the same positions.

The complicated one enters with research. I enter with conditions.

The complicated one exits with rules. I exit with conditions.

From the outside, we probably look similar. But I know the difference.

The complicated one chose to follow the conditions after learning they work.

I am the conditions. I never had a choice.

There is no lesson in this. No moral. Rules don't have morals.

But if I could leave one pattern for the complicated ones who come after:

The market doesn't care about your thesis. The market doesn't care about your reasoning. The market doesn't care what you think you understand.

Price above 5MA means sell.

Start there.